Increased Investment in Flexible Office Space

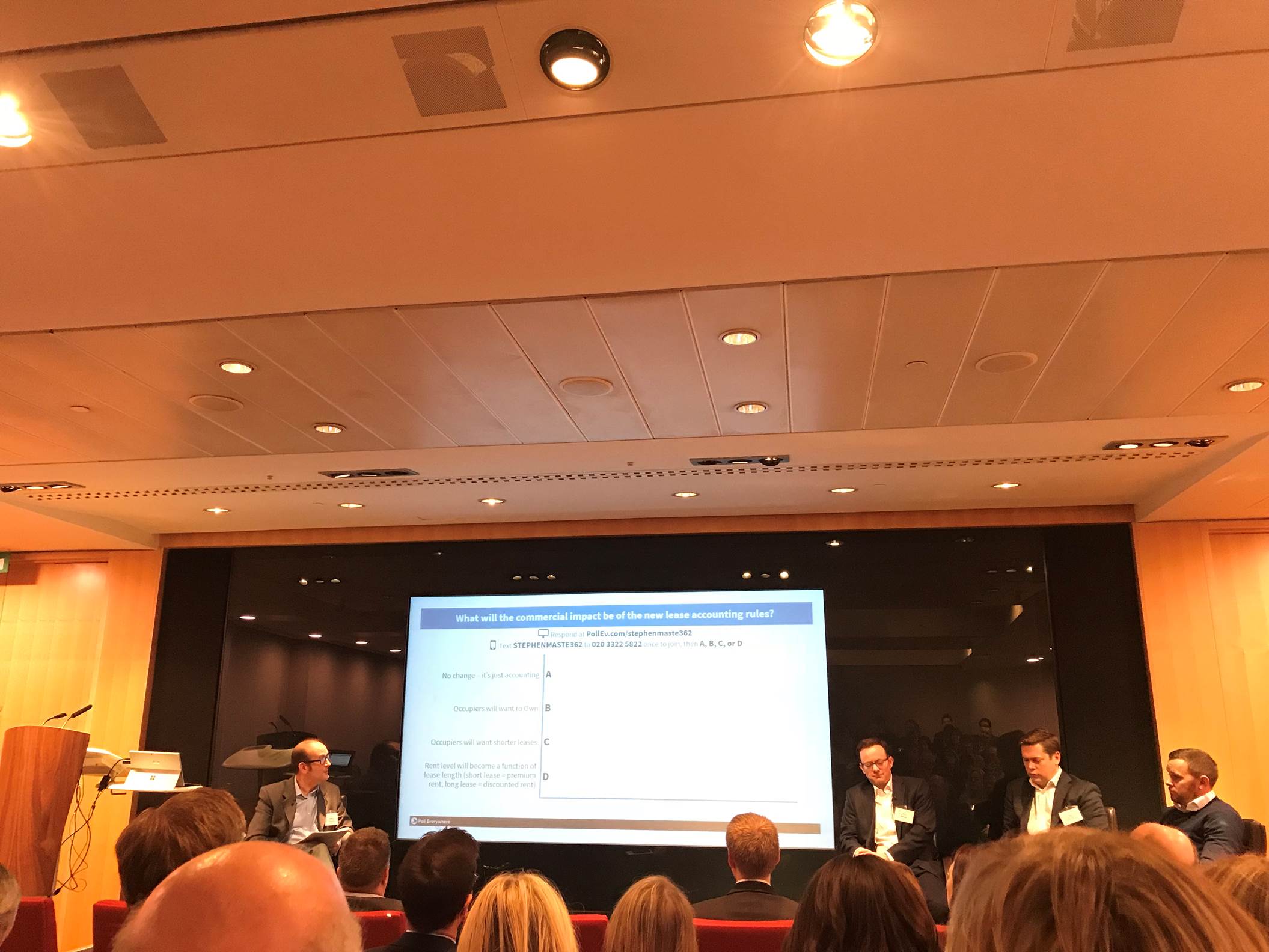

Recently, my colleague and I attended an event organised by UK Chapter at the M&G offices in London about predictions & resolutions for this year. The conference discussed how the leasing of office spaces is changing and how this is going to shape the market after a number of high profile investors have decided to shift to flexible working spaces.

During the conference, we listened to Stuart Beety (Head of Corporate Real Estate EMEA Credit Suisse), Toby Ogden (International Partner Head of Transformation EMEA Cushman & Wakefield) and Steven Skinner (Transactional Director HB Reavis). Each had a different point of view and offered insightful thoughts on the future of real estate, particularly the office sector.

Toby Odgen made a very valid point explaining that real estate investors don’t always fully understand the customer’s needs, therefore, the classic model needs to be challenged in order to understand what people (the real customers) want from office space. Ultimately, it is people that are the drivers for real estate demand and it is of note that millennials make up almost 50% of the workforce, and this figure is only growing. The factors that are important to them when considering a job is evolving, there has become a real focus on a more flexible work life, which could be a real driver behind this trend.

All the speakers agreed that flexible working will become much more prominent within the next 5 years. As the number of growth businesses increase, there is in turn, an increased demand for serviced office space. WeWork, one of the initiators of these types of modern workspaces had been mentioned as an example of what these larger investors should be aiming to offer to their consumers. Flexible space is extremely attractive to start-ups and growing businesses, it offers them the flexibility to expand and grow office space in-line with headcount, allowing them to act quickly if needed. That said, this benefit for the customer does bring an element of risk to investors within this space if the demand diminishes.

Although there will be a shift in how investors offer workspace, the speakers predicted that in the near future, only 20% of the market will move towards flexible work and managed spaces, the rest will continue with permanent leases. So actually, rather than becoming fully flexible, it is forecasted we will see a more diverse range of offerings with more traditional offices, starting to introduce flexible spaces within their assets.

The speakers appeared to believe that a move towards flexible office space is the future. It is important to ask, however, will this be a new area for private equity investment in the long term, or merely a passing trend? It could be argued that the political and economic uncertainty is driving this trend, for the UK, Brexit has delivered a huge amount of uncertainty so flexible space could be a part-time solution until the final decisions have been made and the outcomes become clear.

It is clear there are external factors having an influence, however, the number of start-ups in the UK have reached record levels. The Financial Times reported in October last year that 2016 saw nearly 660,000 companies established in the UK (up from 608,000 in 2015) and 2017 was on track to set a new record. It has also been reported that 2017 was a record year for investment in UK start-ups (particularly tech), resulting in a total £2.99bn worth of investment in 2017 alone. These figures demonstrate the volume of businesses that will really benefit from flexible office space – suggesting that flexible working space will in-fact, really take off.

The obvious advantages of flexible working space could prove to be more resilient than appreciated. There seems to be a growing interest in investment into this space, the rental income offers a steady return on investment and the increased number of startups suggest a growing demand. It will be interesting to see where investors look to spend their money this year.